Beverages Division Volume

The macroeconomic and industry-specific challenges that the Company faced particularly at the beginning of 2014 had a strong impact in overall volume performance for the year. Focused execution and price-packaging strategies resulted in gradual volume recovery during the second half of the year. Within a challenging macroeconomic environment and a competitive market, the beverages division was able to sustain volumes through 2014 with a slight year-over-year increase. Total beverages volume increased 0.4% in 2014 to 1,614 million eight ounce cases compared to 1,607 million eight ounce cases in 2013.

Total soft drink and bottled water case volume increased 0.4% to 810 million eight ounce cases in 2014 from 806.9 million eight ounce cases in 2013. Jug water volume in 2014 increased 0.4% to 804 million eight ounce cases from 800.6 million eight ounce cases in 2013.

0.4%

Volume increase in total beverages volume

Revenue

Excluding revenue generated from the excise tax in the beverages division, total company revenue in 2014 increased 2.6% to Ps.34,333 million from Ps.33,453 million in 2013. Both the sugar and beverages divisions contributed to this growth. In the sugar division, 2014 revenues were up 20% year-overyear. In the beverages division, 2014 revenues were up 0.8% year-over-year, mainly reflecting slight volume recovery and price increases in non-IEPS (excise tax) affected categories. For the twelve months ending December 31, 2014 net revenue per case was Ps.19.5 in the beverages division, a 0.4% increase compared to the Ps.19.4 of 2013. Even though sugary beverages prices did not reflect inflationary effects, on average revenue per case in the soft drinks segment remained flat, an enhanced volume mix of more profitable packages and products partially compensated for the top line challenges. In addition, soft drinks categories not impacted by the excise tax – i.e., water and non-caloric beverages –increased prices in line with inflation, contributing positively to yearover- year revenue performance.

1 Net sales do not include revenues from excise tax (IEPS); 1 peso per liter of sugary beverages. Including revenues from the excise tax CULTIBA total revenues were Ps. 37,908 million.

2.6%

increase in consolidated revenues during 2014

3.9%

gross profit per case growth in 2014 vs 2013

Cost of goods sold

Total company cost of goods sold, was Ps.20,494 million in 2014, 4.9% above the same period of 2013. This figure excludes costs related to the excise tax on sugary beverages, which the Company’s auditors consider as part of COGS. Also, total cost of goods sold figure excludes the non-cash adjustment of Ps.1,600 from the reduction of goodwill related to the sugar business – as a result of lowering the expected price of sugar in the subsidiary’s valuation model to reflect a more conservative market environment from 2015 and going forward.

In the beverages division, unit costs per case in 2014 were approximately 2.0% lower in comparable terms from the same period of 2013. Overall marginal contribution improved through 2014 in the beverages division even within pricing and exchange rate challenges, mainly as a result of cost savings at the beginning of the year in addition to enhanced volume mix from more personal-sized packaging in soft drinks. As a result, gross profit per unit case increased 3.9% year-over- year during 2014 for the beverages division.

Selling, general and administrative expenses (SG&A)

Consolidated SG&A in 2014 was Ps.13,591 million, basically flat when compared to Ps.13,509 million in 2013. Successful execution of several cost savings initiatives in both the beverages and sugar divisions since late 2013 resulted in a leaner fixed cost structure for the Company. As a result, SG&A, as a percent of revenue slightly decreased to 39.6% in 2014 from 40.3% in 2013. Operating efficiencies achieved during 2014 were somewhat offset by material non-recurring expenses related to the savings program in the beverages division. During 2014, non-recurring expenses totaled Ps.397 million.

As a reminder, deployment of the beverages division’s savings program started in 4Q13 in anticipation for the challenges to come through 2014. As a result, the Company reported nonrecurring expenses of Ps.101 million for 2013. As of December 31 2014 and including 2013 initiatives, total non-recurring expenses related to the cost savings program totaled Ps.408 million. An additional expense of Ps.80 to Ps.90 million is expected through 2015, ending all one-time costs related to the entire savings program with ongoing SG&A expenses going forward more accurately reflecting the costs of the business.

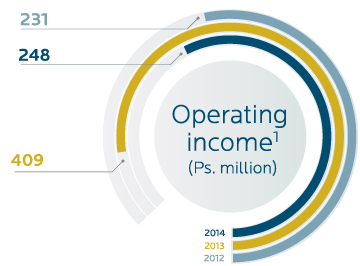

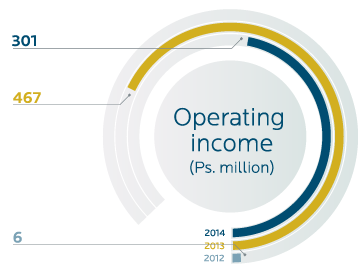

Operating income

Operating income for the Company was Ps.248 million in 2014. This figure does not include the noncash impact of Ps.1,600 million related to the reduction of goodwill in the sugar division mentioned before. Adjusting for such impact, Cultiba had an operating loss of Ps. 1,352 million compared to an operating income of Ps.409 million in 2013. In the beverages division, operating income was Ps.301 million in 2014, 35.5% below the Ps.467 million in 2013. Operating income was impacted by material non-recurring expenses in the beverages division through the year. Adjusting for nonrecurring expenses, operating income in the beverages division reached Ps.698 million in 2014.

CONSOLIDATED

1 Operating income does not include non-cash impact from reduction of goodwill related to the sugar division. Including such non-cash impact, Cultiba’s operating loss of was Ps.1,352 in 2014.

BEVERAGES DIVISION

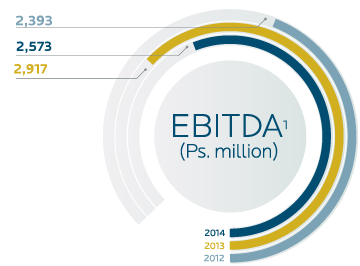

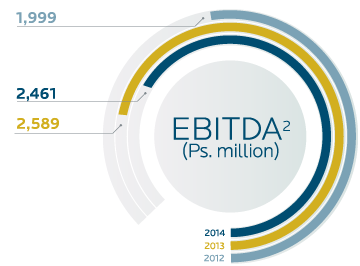

EBITDA

Lower-than-expected volumes and prices in addition to non-recurring expenses mentioned before resulted in a year-over-year decrease of 11.8% in total EBITDA. Without adjusting for non-recurring expenses, total EBITDA for the Company was Ps.2,573 million compared to Ps.2,917 million in 2013. As a result, EBITDA margin in 2014 was 7.5% compared to 8.7% in 2013. Also not adjusting for one-time expenses, EBITDA in the beverages division was Ps.2,461 million, 5.1% below the Ps.2,589 million of 2013. As a result, EBITDA margin in the beverages division was 7.8% in 2014, compared to an 8.3% EBITDA margin in 2013. Adjusting for non-recurring expenses, the beverages division did show improved profitability with a 46 basis points margin expansion; reaching 9.1% EBITDA margin in 2014 compared to an adjusted margin of 8.6% in 2013.

CONSOLIDATED

BEVERAGES DIVISION

CONSOLIDATED

BEVERAGES DIVISION

1 EBITDA = Net income plus: (1) Depreciation and amortization (2) Net financing cost, (3) Provision for taxes (4) for 2014: non-cash impact of Ps.1,600 million reduction to goodwill related to the sugar division.

EBITDA does not adjust for non-recurring expenses related to savings program. These expenses were Ps. 101 million in 2013 and Ps. 397 million in 2014. Adjusting for non-recurring expenses, consolidated EBITDA was Ps.3,018 million in 2013 and Ps.2,970 million in 2014.

2 EBITDA = Net income plus: (1) Depreciation and amortization (2) Net financing cost, (3) Provision for taxes EBITDA does not adjust for non-recurring expenses related to savings program. Adjusting for non-recurring expenses, the beverages division’s EBITDA was Ps. 2,858 million in 2014 and Ps. 2.690 million in 2013.

3 EBITDA margin does not adjust for non-recurring expenses related to savings program. Adjusting for such expenses EBITDA margin was 9.1% in 2013 and 8.6% in 2014 at the consolidated level, and 8.6% in 2013 and 9.1% in 2014 for the beverages division.

Financing cost1

Financing cost for 2014 resulted in a net expense of Ps.506 million compared to a net expense of Ps.405 million in 2013. Continued reduction of short and long term obligations in both subsidiaries have resulted in a reduction of overall financing costs. Total cash-interest payments were 32% lower in 2014 compared to 2013. However, non-cash exchange rate losses were Ps.311 million in 2014, compared to Ps.55 million in 2013. Most of these losses resulted from the Mexican peso devaluation that took place late in the year and partially offset the positive effects of lower cash-interest payments within total financing costs. Long-term dollar denominated debt is fully hedged with future dollar denominated cash inflows in both divisions.

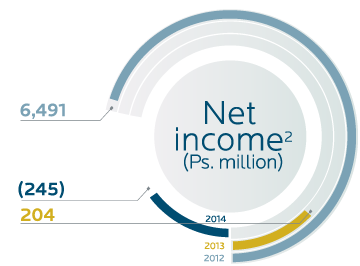

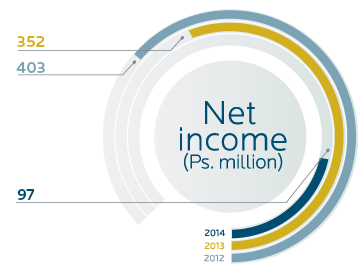

Net income

Net income reported for the twelve months ending December 31, 2014 is unrepresentative of Cultiba’s businesses operating reality due to distortions resulting from material non-cash charges that the Company had to apply after adjusting the value of goodwill in its balance sheet. As mentioned before, goodwill associated to the value of the sugar division has been adjusted to reflect the challenges of a changing market environment from the last two years, after which pricing is seen with high probability to remain soft for the greater part of 2015. Excluding this non-cash one time charge of Ps.1,600 million, the Company reported a consolidated net loss of Ps.245 million, compared to net income of Ps.204 million in 2013.

CONSOLIDATED

BEVERAGES DIVISION

1 Includes non-cash impact from exchange rate fluctuations, which were a loss of Ps.311 million in 2014 and a loss of Ps.55 million in 2013. Such non-cash losses are subtracted from the comprehensive cost of financing in the report submitted to the Mexican Stock Exchange (BMV, Spanish Accronym). As for the IFRS, exchange fluctuation is included under “Other Products” In the audited financial statements. However, for the report submitted to the BMV they can be included under “Comprehensive Cost of Finance”

2 Net income does not include non-cash impact of Ps. 1,600 million from the reduction of goodwill related to the sugar division. Adjusting for such non-cash impact, the Company had a consolidated net loss of Ps.1,845 million in 2014.

Indebtedness

As of December 31, 2014 the Company had Ps.396 million in cash and equivalents, compared to Ps.1,083 million on December 31, 2013. Net debt outstanding at the end of 2014 was Ps.4,351 million compared to Ps.6,302 million at year-end 2013, mainly as a result of the sugar division’s deleveraging of working capital and of both divisions’ repayment of long-term debt.

The following table shows debt levels in each of Cultiba’s subsidiaries as of December 31, 2014…

(Ps. in million)

| Beverages Division | Sugar Division | CULTIBA Consolidated2 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Dec 31 2014 | Dec 31 2013 | Var. | Dec 31 2014 | Dec 31 2013 | Var. | Dec 31 2014 | Dec 31 2014 | Var. | |

| ST Debt | 2,286 | 3,524 | -35.1% | 595 | 286 | 108% | 2,909 | 3,976 | -26.8% |

| LT Debt | 0 | 1,394 | -100% | 447 | 634 | -29.5% | 1,838 | 3,409 | -47.3% |

| Net Debt | 2,069 | 4,619 | -55.2% | 999 | 818 | 22.1% | 4,351 | 6,302 | -30.9% |

2 Includes Long Term Certificates in the Mexican Market issued on November 2013 by the Holding Company

1 Net Debt / EBITDA ratio in 2013 includes short term obligations for Ps. 2,750 million related to prepaid raw materials that the beverages division reported by year-end 2013. Excluding such short-term obligations 2013 Net Debt / EBITDA ratio was 1.2X in 2013.

Working capital

Reductions in advanced payments incurred in 2013 strengthened working capital levels through 2014. In addition, improved operating cash cycles at the beverages division also contributed to operating working capital performance. Finally, working capital at the beverages division was positively impacted by the excise tax cash that is collected from clients upon sales but is paid to regulatory entities at the end of the period. This extraordinary cash flow event will be offset by next year in the comparable period.

CAPEX

Total capital expenditures through December 31 2014 were Ps.1,872 million, compared to Ps.2,929 million in the same period of 2013. Amidst the slow consumer environment that delayed top-line recovery, capital expenditures during 2014 prioritized investments that were crucial to maintain the Company’s competitive position in the new and challenging market environment. The Company deployed funds for infrastructure modernization programs, productivity increases in its manufacturing and distribution networks, improved presence in specific channels, as well as portfolio and packaging initiatives to sustain top-line growth. Within the challenges of 2014 the Company was able to stay close to its original CAPEX plan and continue investing in the foundations to support its growth and productivity plans for the years to come.

Organización Cultiba

Diana González Flores

Investor Relations

+52 (55) 5201-1947

dgonzalez@gamsa.com.mx

Monte Cáucaso 915, fourth floor,

Colonia Lomas de Chapultepec

C.P. 11000, México, Distrito Federal

Tel. +52 (55) 5201-1900

www.cultiba.mx