ADVANTAGES

During 2014 we continued strengthening our integrated business model focusing on our five strategic imperatives

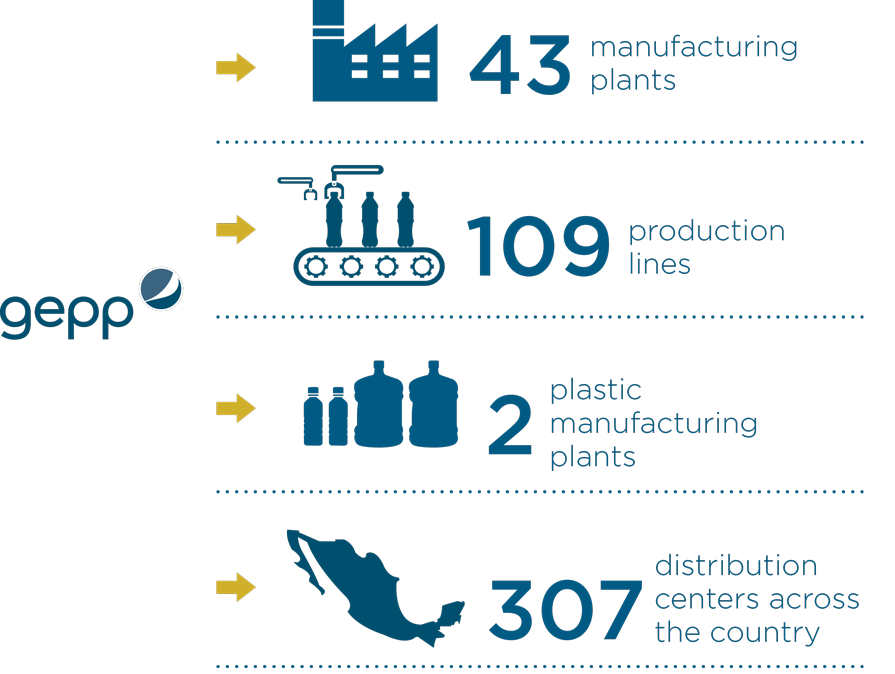

GEPP IS THE SOLE BEVERAGE BOTTLER IN MEXICO WITH A NATIONWIDE DISTRIBUTION NETWORK Our subsidiary, GEPP, is the only bottler with a nationwide distribution network in Mexico, serving nearly 740,000 points of sale for beverages from the PepsiCo brand, private labels and third party brands. Through its wide network, GEPP has achieved nationwide presence, reaching a combined sales volume of beverages and jug water of 1,614 million eight ounce cases, which represents a 0.4% annual increase over the previous year, in a near zero-growth industry. GEPP’s broad distribution network for jug water directly serves three channels: home, businesses and institutions. Through this network GEPP reaches more than 2 million homes. |

|

OPERATING EFFICIENCIES We continue making significant operational and production enhancements that contribute to margin expansion and allow our companies to further optimize operations. During 2014, we maintained our focus on increasing the efficiency of procurement processes, distribution, technologies standardization, operational integration and administrative processes optimization. These actions allowed us to achieve operational improvements and protect profit margins during a challenging year. Such improvements will continue to enhance our cost structure in a sustained manner. |

|

A WIDE PORTFOLIO OF LEADING BRANDS Based on its price-packaging architecture and innovation, GEPP continues to focus on growing its portfolio of beverages, as demonstrated by the launch of Barrilitos®, Epura Bebé® and new flavors of Jumex Fresh®, all of which were positively received by consumers. Related marketing campaigns launched by the beverages division successfully contributed to reinforce core brands positioning. Additionally, specific channel strategies were implemented to increase coverage of GEPP products throughout Mexico. |

|

AN APPEALING MARKET As a result of its geographic presence, GEPP continues to benefit from growth opportunities offered by the Mexican market. The territory remains attractive and valuable, since Mexico keeps one of the highest per capita consumptions of carbonated drinks, at nearly 160 liters per year. According to information from Canadean1, the carbonated beverages segment generated approximately US $ 20 billion dollars in total sales with volume sales of 19 billion liters in 2014. Total 2014 sales of non-carbonated beverages reached approximately US $11 billion dollars with a sales volume of 11.5 billion liters. The jug water market in Mexico remains attractive with 2014 sales of US$ 2.2 billion dollars, and sales volume over 23.5 billion liters. Mexico remains among the highest consumers of bottled water in the world, at nearly 200 liters per capita per year. The jug water segment in Mexico has consolidated significantly, switching from small vendors and street distributor to large companies with recognized, brands and regional or national coverage. Factors such as the growth of a health and wellness culture, as well as the poor quality of public drinking water, continue to contribute positively to the development of this market. 1 Canadean is a global consultancy firm that provides information on market dynamics for different industries, including carbonated and non-carbonated drinks as well as bottled water (including jug water). |

|

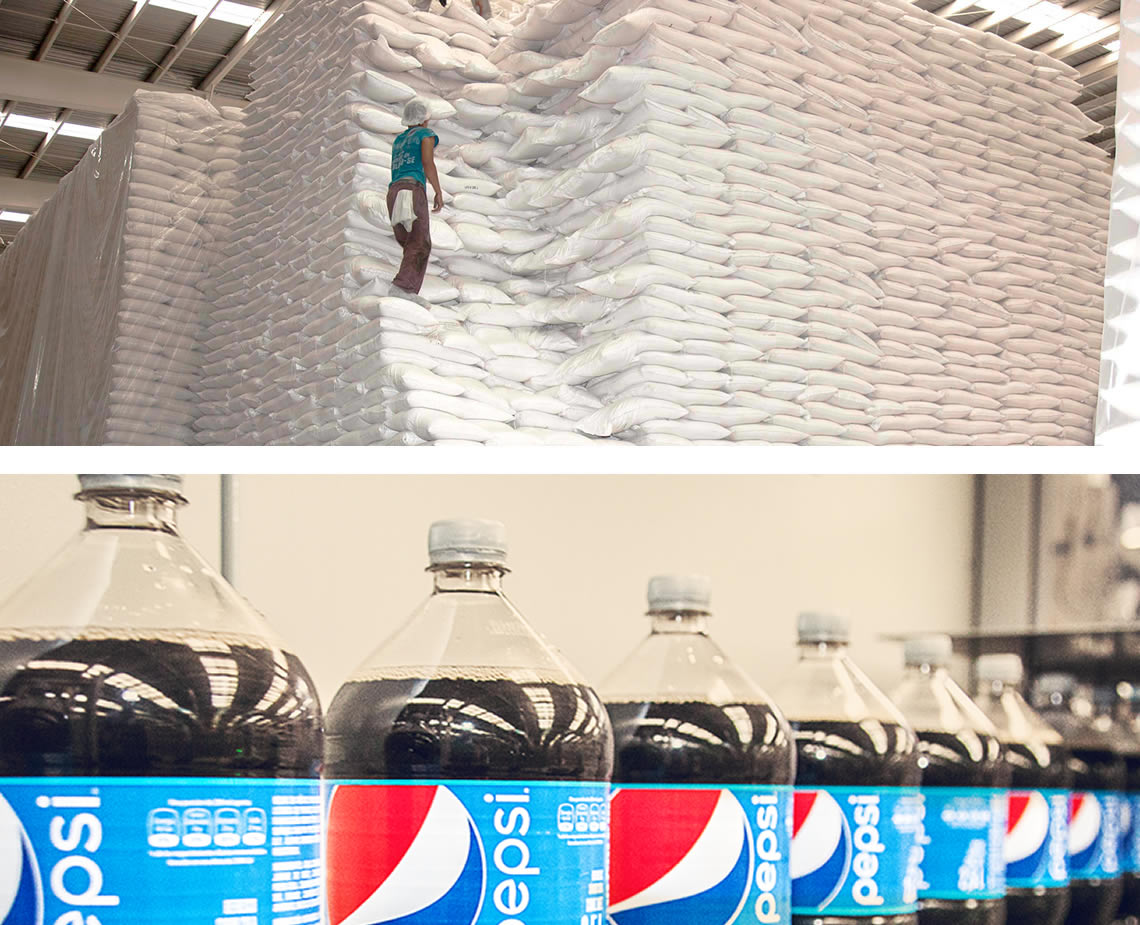

VERTICAL INTEGRATION We continue to seek cost efficiencies through vertical integration, whereby our sugar business, GAM, supplies almost 100% of the sugar needs for GEPP’s beverages production. This also provides a natural hedge against sugar price fluctuations. Moreover, our co-generation power plant in our Tala Mill, located in the state of Jalisco, provides electricity to both GEPP and our sugar mill. Similarly, within our beverages division we have two plastic manufacturing plants producing plastic bottles and caps used by GEPP in the beverages bottling processes. |

Organización Cultiba

Diana González Flores

Investor Relations

+52 (55) 5201-1947

dgonzalez@gamsa.com.mx

Monte Cáucaso 915, fourth floor,

Colonia Lomas de Chapultepec

C.P. 11000, México, Distrito Federal

Tel. +52 (55) 5201-1900

www.cultiba.mx